For the profitability of any enterprise estimating cost and returns is of utmost importance. In dairy enterprises where estimation of cost is totally different from that of estimation of cost in case of crops. There is no outlined procedure for its estimation in dairy enterprises. Thus following description gives a vivid explanation of estimation of cost and returns in milk production.

The total cost involved in the dairy farm operations composed of fixed cost and variable cost. These costs when compared with returns indicate economic efficiency of milk production and the profitability of the enterprise. The different components of costs and returns, their definition and method of calculation are discussed briefly in the following section.

Fixed costs: Fixed costs do not vary with the level of output and remain unchanged over a short period of time. The various components of fixed cost are depreciation and interest on fixed capital. Capital Recovery Cost (CRC) method can be used to calculate fixed cost. The interest on fixed capital does not need to be accounted for separately in CRC approach. Fixed cost can also be calculated through straight line method of depreciation. Cost recovery cost method is described as below

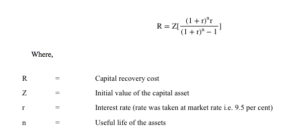

Depreciation costs: It is the loss in the value of an asset due to normal wear and tear, time and technological obsolescence. The Capital Recovery Cost (CRC) method can used to estimate depreciation cost is defined as the annual payment that will repay the cost of fixed input over the useful life of input and provide an economic rate of return on investment. The formula for estimation of CRC is:

Instead of initial outlay at the field level, the current value of asset is to be considered. If the asset was purchased from borrowed capital, the actual interest rate charged by the bank was taken as ‘r’, while in case of owned funds, the interest on term deposit of 1-5 years can be taken. The useful life of assets is assumed to be 50 years for pucca cattle shed, 10 years for katcha shed, 6 years for manual chaff cutter, 10 years for power operated chaff cutter. The useful life of milch animals also varied with the type of animal and was taken as 10, 8 and 10 years for local cow, crossbred cow and buffalo, respectively. The total CRC was then apportioned to the individual animal in accordance with the Standard Animal Units (SAUs).

Variable Cost: Variable costs are those costs, which are incurred on the variable factors of production and can be altered in the short run. The major variable costs are feed and fodder cost, labour cost and veterinary and miscellaneous expenditure.

Feed and Fodder Cost: This included the cost of feeding dry fodder, green fodder and concentrates to animals. In case of purchased feed and fodder, the cost can worked out as product of quantity fed to animal and purchase price of respective feed. In case of home-grown feed and fodder, the relevant prices were the farm-harvest prices. For certain types of fodder, especially cultivated green fodder, where farm-harvest prices are not available, the imputed value of crop can taken at prevailing price in the village. When the concentrate feed is prepared at home, its cost can be computed by taking the weighted prices of ingredients used in the concentrate, the weights being the share of each ingredient in the concentrate composition.

Labour Cost: It included cost of family as well as paid labour (hired labour). The cost of hired labour is calculated considering type of work allotted and wages paid whereas, family labour costs were determined on the basis of existing wage rate of permanent farm labour.

Veterinary and Miscellaneous Costs: The expenditure on breeding and health care of the animals is covered under the veterinary expense. It included, cost of artificial insemination (AI), natural service, vaccination, medicines, fee of veterinary doctor and other related expenses. The miscellaneous expenditure included expenses on repair of fixed assets, water and electricity charges, insurance premium and any other incidental charges. These being joint costs, apportionment of the same were based on SAU.

Cost Concepts:

Gross cost: It can be obtained by adding all the cost components including fixed and variable costs.

Gross cost = Total variable cost + Total fixed cost

Net cost: The net cost can be worked out by deducting the imputed income earned through dung, from the gross cost.

Net cost = Gross cost − Value of dung

Gross returns: Gross returns can be used obtained by multiplying milk yield of an individual milch animal with respective prevailing prices in the study area

Gross returns = Quantity of milk × Market price of milk

Net returns: Net return can be calculated by subtracting net cost from gross returns

Net returns = Gross returns -Net cost

Cost of Milk Production: All the costs are calculated for per animal per day which indicates the cost of maintaining an animal per day. When the cost of maintaining animal can be divided by milk productivity, it gives cost of milk production in terms of cost per litre of milk.